Why Investors Are Looking to Bitcoin DeFi

A trillion dollars of native Bitcoin capital is waiting to be made into a productive asset. DeFi opens the door to a fast, free, fair and borderless financial system, removing associated risks, costs and barriers of traditional banking.

Sign up for updates!

Stay tuned to our latest news and updates

.svg)

What is DeFi?

Decentralized Finance (“DeFi”) is a new digital financial system built on public blockchains. Unlike traditional finance, DeFi allows peer-to-peer transactions, removing the need for intermediary third-party approvals from centralized entities like banks. The funds are secured with cryptography and are not accessible by anyone except the owner, so you don’t need to trust any individual or entity with your funds—hence the terms “self-custodial” and “trustless.” Ultimately, DeFi opens the door to a fast, free, fair and borderless financial system, removing associated risks, costs and barriers of traditional banking.

What’s Yielding on DeFi today?

Today, an overwhelming majority of the DeFi market is on Ethereum (ETH) blockchain, including notable projects such as Compound and Aave. These money market protocols enable users to put their crypto to work – essentially lending out their crypto to earn a yield. For example, fiat-backed stablecoins have delivered double-digit annual returns, which is higher than what you could get in a traditional bank.

On the other hand, you can also borrow by using your crypto holdings as collateral in exchange for liquidity to be paid back over time. Once the loan is paid back, your crypto holdings are returned in full. Additionally, Decentralized exchanges (“Dex”) like Uniswap on Ethereum and ALEX on Bitcoin are enabling peer-to-peer trading of crypto assets without any kind of brokerage in the middle.

Now anyone in the world with an internet connection has the ability to earn interest, borrow, lend, trade assets and derivatives, buy insurance, and more. “The trust-minimized application market and the smart contract market is essentially the largest technology market in the world.” – Sergey Nazarov, Co-Founder of Chainlink Labs

Why DeFi Must Upgrade to Bitcoin

Bitcoin’s hashpower makes it the most secure blockchain network in existence. In order for DeFi to succeed in global adoption, you need the stability and security that only Bitcoin can provide. “Bitcoin is a pristine piece of collateral with the most credible monetary policy on earth,” says Dan Held, Bitcoin educator and marketing advisor at Trust Machines. As a result, a trillion dollars of native Bitcoin capital is waiting to be made into a productive asset.

However, since Bitcoin itself does not have advanced smart contract capabilities required for DeFi, Bitcoin holders who want to access DeFi have often chosen to use wrapped versions of Bitcoin such as WBTC. When users entrust Bitcoin with third-party custodians, this creates a great amount of risk with already over $40B lost due to hacks and human error. And there is more.

The big draw of Bitcoin versus other digital currencies, like USDC, is that Bitcoin is censorship resistant and you lose that benefit immediately when you wrap it. - Aki Balogh, CEO of DLC.Link as stated in the latest Own Your Crypto podcast Episode 2: Why Investors Are Looking to Bitcoin DeFi.

How Stacks Makes Bitcoin DeFi Possible

While very simple smart contracts are possible on Bitcoin, more powerful and expressive smart contracts required for DeFi applications did not exist until the launch of the Stacks blockchain in January 2021. Stacks’ ability to read native Bitcoin state makes it uniquely positioned to host DeFi on top of Bitcoin, using a unique consensus mechanism called proof of transfer (PoX). PoX enables Stacks blocks to be secured using existing Bitcoin proof-of-work (PoW). Now advanced smart contracts required to leverage Bitcoin’s security, capital and network capabilities are possible without making any changes to Bitcoin itself.

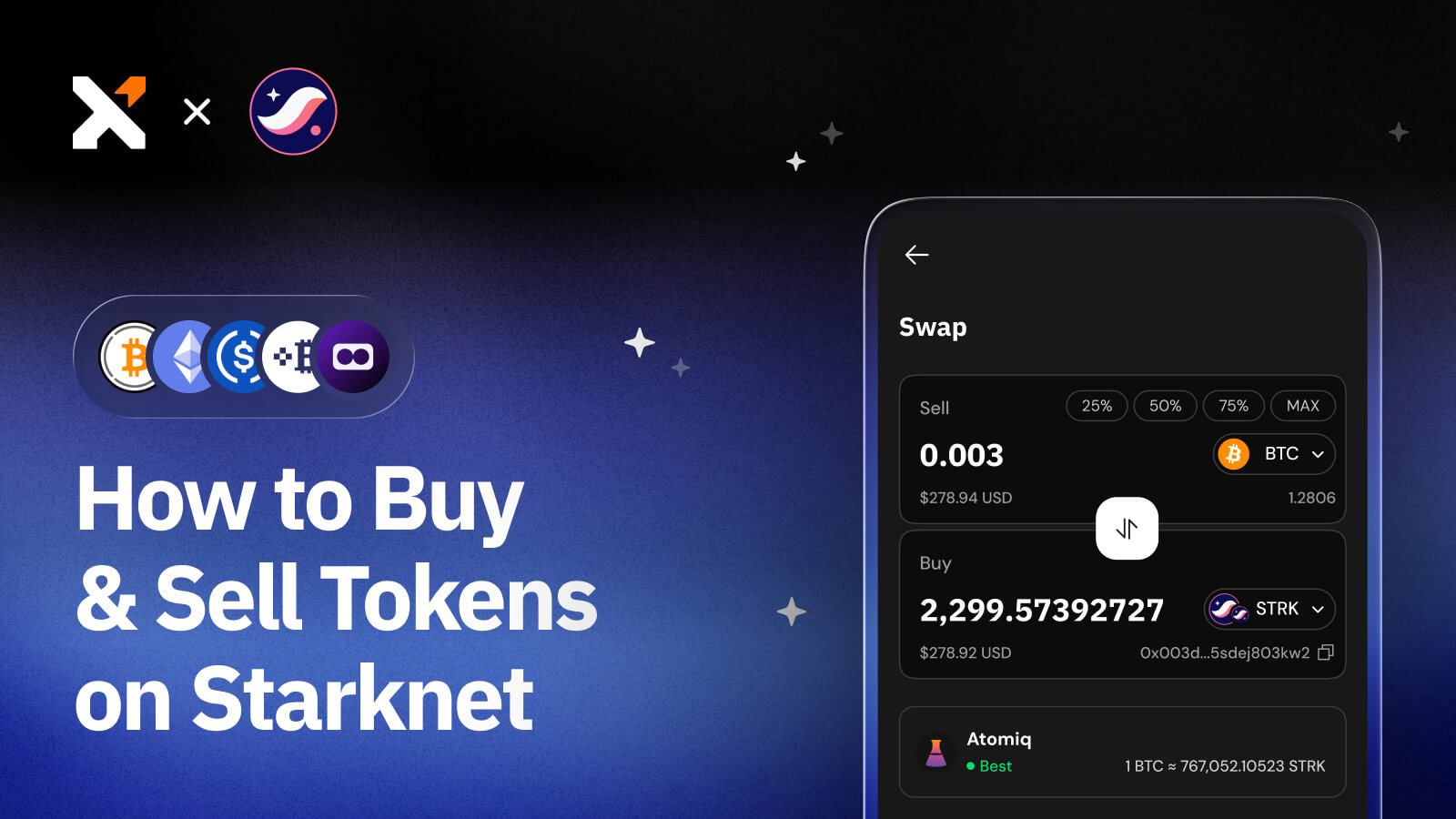

Accessing Bitcoin DeFi Apps with Xverse Wallet

Currently, the most popular use cases in the Bitcoin DeFi market include lending, trading, staking, and stablecoins. To access these DeFi apps, you’ll need to connect using a Bitcoin wallet that supports Stacks.

Xverse wallet offers an in-app browser so you can easily connect to Bitcoin DeFi in four easy steps:

- Download the Xverse app, available for Android and iOS

- Carefully make a note of your secret recovery phrase. You’ll need these to restore your wallet if it gets reset.

- Go to the browser and type the URL of the desired Bitcoin DeFi application (for example, “alex.io”).

- Click “connect wallet.”

That’s it! Now you can browse, login, and sign transactions for Bitcoin DeFi platforms. Now let’s take a look at some of the leading Bitcoin DeFi platforms on Stacks and what decentralized products and services they currently offer.

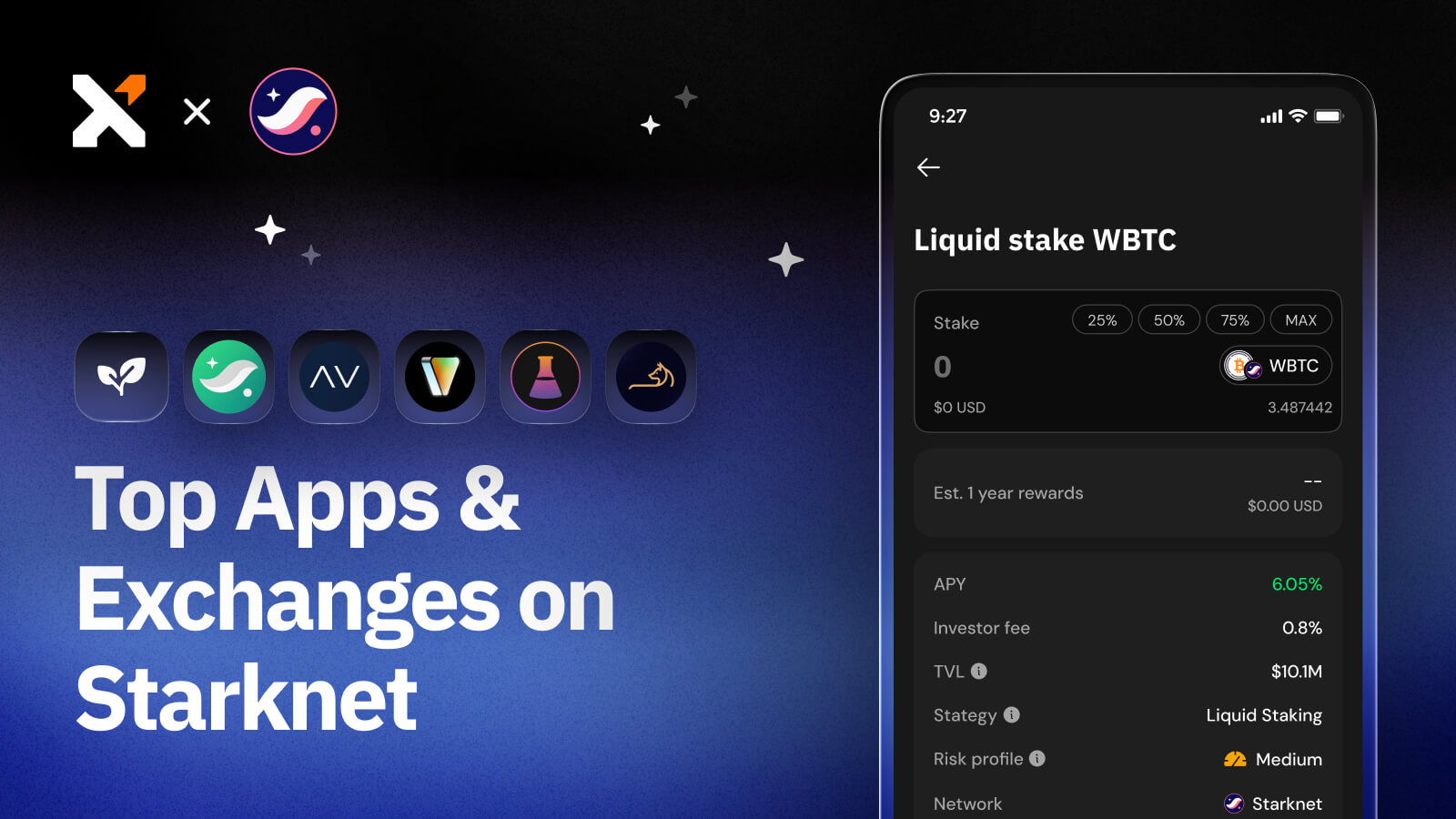

Five Bitcoin DeFi Protocols

1. ALEX: Lend, Borrow, and Yield Farm Bitcoin DeFi

Alex allows users to lend and borrow BTC at flexible rates without risk of liquidation, swap tokens with AMM and Order-Book, and maximize profits with yield farming and staking $ALEX. Alex has made their Orderbook testnet available for contributors with reward incentives, with the goal of creating the best protocol for users.

Bitcoin doesn't need DeFi, but we truly believe that DeFi needs Bitcoin. Without the security and imutability unique to Bitcoin, DeFi will never achieve mass adoption. - Dr. Chiente Hsu, Founder of ALEX

2. Arkadiko: Bitcoin DeFi Liquidity Pool

Arkadiko kickstarted DeFi on Stacks with a non-custodial liquidity protocol, allowing users to collateralize STX tokens and mint a stablecoin called USDA. This enables yield farming: depositors gain increased liquidity in the form of a soft-pegged US Dollar stablecoin, while maintaining original asset exposure.

Utilizing yield from Stacks PoX, a STX-collateralized Vault that mints USDA creates a self-paying loan. Similar to MakerDAO, Arkadiko increases the capital efficiency of the STX asset by enabling it to be used in a collateralized debt position.

Additionally, users can swap tokens in a trustless manner, deposit liquidity in tokens, or add their own pairs to enable trading on tokens they have created themselves. Users can also vote on proposals, e.g. changing risk parameters on Arkadiko collateral types, by staking stDIKO tokens.

While a current custodial tokenized version of BTC exists on Stacks, first federated and eventually completely decentralized representation are in the works. The potential to use Bitcoin as a collateral asset in Clarity smart contracts on Stacks could position Arkadiko as key infrastructure in the layered future of Bitcoin.

3. CityCoins: Bitcoin DeFi Philanthropy

One of the first projects to launch on Stacks was New York City's and Miami's CityCoins, generating $50 million for their respective city treasuries. Mining CityCoins is performed by forwarding STX tokens into the smart contract in a given Stacks block. Miners are rewarded with new CityCoins tokens while 70% of mining rewards are distributed stackers and 30% are sent (in STX) to a city's custodied reserve wallet. The cities can claim these funds whenever they want, and then use them for philanthropic efforts.

This is a new tool for cities to put their toolkit that they'll want. - Patrick Stanley, CityCoins Community Lead

4. DLC.Link: Bitcoin DeFi Oracle

DLC.link is the first Bitcoin oracle network, building a bridge that lets app developers lock Bitcoin in non-custodial, trustless escrow. This bridge enables new types of DeFi applications that weren’t possible before, ranging from lending, options, futures and more. Each of these use cases are multi-Billion dollar markets in their own right, meaning that there’s opportunity for thousands of applications built on top of this bridge. DLC.Link is also working with Arkadiko to create a self-custody $BTC stablecoin.

5. Zest: Bitcoin DeFi Lending

Zest Protocol is creating a free market for credit assessment for undercollateralized Bitcoin, onboarding the $120 trillion bond market. Users will earn BTC rewards (starting avg. 6% APY) by lending through professionally-managed liquidity pools to eligible institutional borrowers. Zest pools are managed by pool delegates who whitelist borrowers off-chain and and get a return by sharing in the reward payments. Now institutions can enjoy undercollateralized on-chain Bitcoin financing without the risk of liquidation.

Turning Bitcoin into a productive asset is what's needed to achive the next wave of institutional adoption. - Tycho Onnasch, CEO of Zest Protocol

Bitcoin DeFi for a Better Future

Bitcoin DeFi is the next step in creating a more efficient, censorship-resistant financial system, resulting in faster economic velocity. A pro-innovative approach is in the interest of regulators as it generates more wealth for society as a whole, which in turn attracts more talent. Bitcoin DeFi is at the cutting edge of delivering on that effort, and Xverse is the gateway to accessing these protocols.

Share this article

.svg)